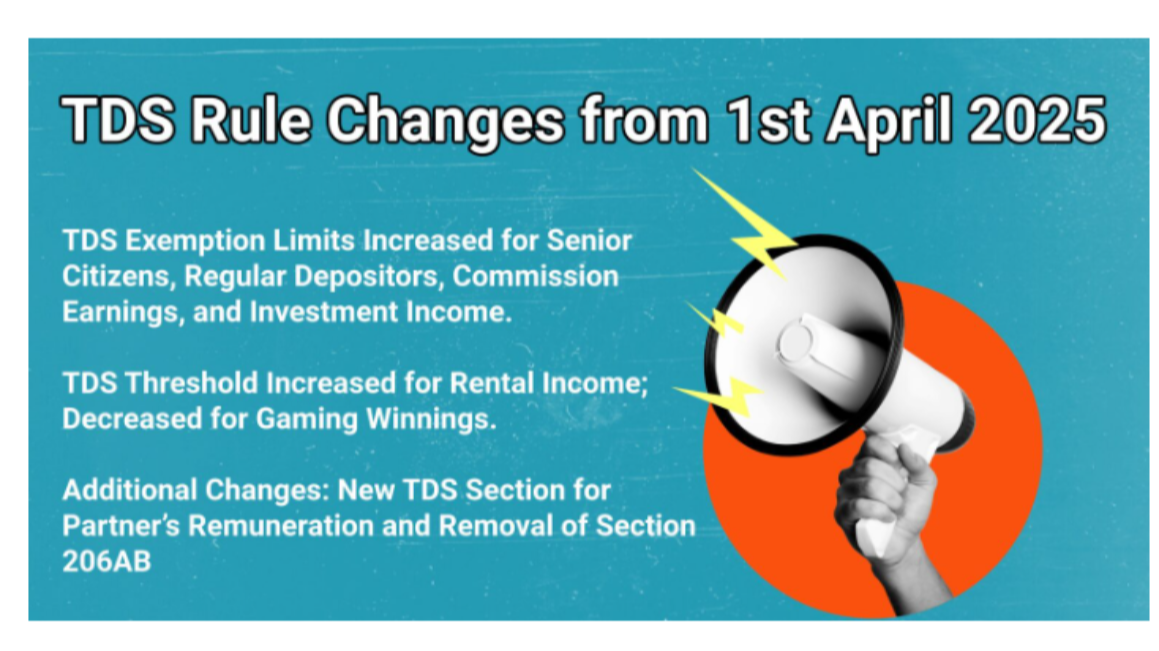

Income Tax TDS & TCS Changes Effective From April 1 2025

Threshold rationalisation: Several TDS thresholds were raised (interest, dividends and certain other heads) to reduce nuisance TDS and comply with administrative simplification introduced in the Finance Act, 2025. Specific rate changes: A few sector-specific rates were changed (for example, certain TDS rates such as under section 194LBC — that apply to income of investment funds — were reduced as part of the Finance Act changes

Subscribe for latest offers & updates

We hate spam too.